massachusetts restaurant alcohol tax

The meals tax rate is 625. In 2011 that number was raised to 5 as of 2016 it was raised to 7 and in 2020 it will rise to 9.

Bill to allow alcohol takeout delivery at Massachusetts restaurants on Gov.

. Charlie Baker signed a bill on July 20 allowing bars and restaurants in the state to sell to-go cocktails with takeout and delivery food orders. Chicago Restaurant Tax. Charges directly relating to food or beverages being sold including preparation set-up at the customers location serving bartending and clean-up.

Alcohol Tax Plan Roils Boston By Peter Howe Published September 24 2015 Updated on September 24 2015 at 713 pm Published September 24 2015 Updated on September 24 2015 at 713 pm. Generally food products people commonly think of as groceries are exempt from the sales tax except if they are sold as a meal from. Massachusetts Restaurant Revitalization Fund Set-Asides.

Charlie Bakers desk. The safety net for Massachusetts residents struggling with the new realities of daily life. While it may seem like an overwhelming process to obtain a Massachusetts Alcohol Tax there is a more simple and efficient way to stay on the.

The bill allows customers to order. 5 billion is set aside for applicants with 2019 gross receipts of not more than 500000. Multiple snowstorms have kept people stuck inside and the proposed meals tax holiday March 20.

Some tax discounts are available to small brewers. The following separately stated charges are also subject to tax. Therefore the total excise tax on spirits is 2630 per gallon.

Meals are also assessed at 625 but watch out. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys tax of 125 Chicago the total tax Chicago-based restaurants face is 925. Drivers of any age guilty of OUI face both administrative and criminal penalties.

Your communications with us are also confidential protected by the attorney-client privilege. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is presumed to be the meals tax vendor whether the meals are served by the license holder or a concessionaire. Deval Patrick tried repeatedly without success to tax soda and voters in 2010 rejected higher taxes on alcohol but supporters of.

Driving under the influence of alcohol in Massachusetts is a crime that is punishable by a fine andor imprisonment. Generally non-itemized charges from a catering business to its customer in Massachusetts are subject to sales tax. Federal excise tax rates on beer wine and liquor are as follows.

Previously an entity such as a grocery store chain in MA could hold up to 3 liquor licenses. The state charges driver under the age of 21 with a BAC of 002 or higher with OUI. However it could be as high as 500.

Massachusetts maximum blood alcohol level is 008 and 002 if the driver is under 21 years of age. BOSTON When shoppers hit the malls and Main Streets later this month during the states tax-free weekend their lunch or dinner will continue to be taxed at 625. The penalty for driving with an open alcohol container anywhere except in the trunk is a fine of at least 100.

The tax is 625 of the sales price of the meal. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. Find out more about the citys taxes on Chicagos government tax list.

The allowance will last until Baker lifts Massachusetts state of emergency which was enacted on March 10 2020 in response to the pandemic. So for example as of now up to 7 Stop and Shops could sell beer wine and. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol.

To schedule an initial consultation with an experienced tax lawyer call 866-485-7019 or complete our online contact form. Some area restaurant owners say legislation supported by 20 state senators and representatives that would eliminate the states 625 percent meals tax on food and alcohol for a week in March would give local restaurants much-needed attention reports the Worcester Telegram. Whether you are facing an audit or want to safeguard your restaurant operations we have the experience to assist you.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. 1350 per proof-gallon or 214 per 750ml 80-proof bottle. 625 of the sales price of the meal.

Some jurisdictions in MA elected to assess a local tax on meals of 75 bringing the meals tax rate to 7. In MA transactions subject to sales tax are assessed at a rate of 625. 7 Operating under the influence penalties can vary depending on prior OUI offenses.

Massachusetts restaurant alcohol tax Saturday May 14 2022 Edit. Annual event is Aug. Under 15 110gallon over 50 405proof gallon 057 on private club sales.

An additional 4 billion is set aside for applicants with 2019 gross receipts from 500001 to 1500000.

6 Practical Tips For Saving Money In Iceland Guide To I In 2022 Wow Air Iceland Visit Iceland

60 Signs Facades And Frames Mockups Frame Mockups Presentation Design Mockup Design

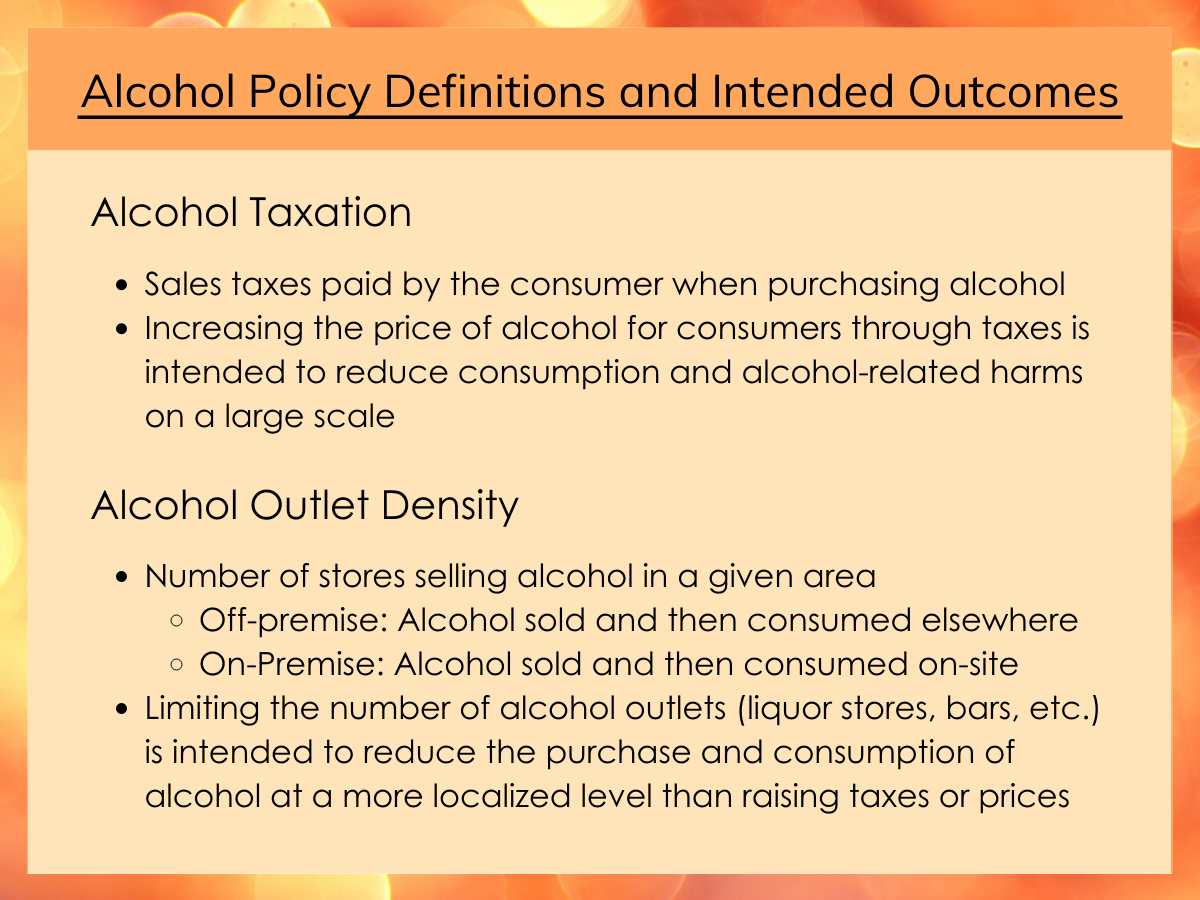

Price And Availability Revisited Do Alcohol Taxation And Sale Restrictions Also Reduce Harms For Marginalized Groups

Event Poster Event Poster Postcard Art Job Inspiration

How Does Selling Alcohol On Doordash Work

Massachusetts Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Get Rewarded At Lunch Buy 5 Lunches At El Mariachi At Wareham And Your 6th Is On Us Pick Up A Rew Loyalty Rewards Program Loyalty Card Rewards Program

The Ultimate Liquor Pricing Guide For Bar Managers

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild

Massachusetts Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Devotion Vodka A Gluten Free Sugar Free Vodka Line Now Distributed At Wegmans

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Bid On A Thanksgiving Dinner For 10 For This Year S Thanksgiving Day At The Boston Marriott Quincy Hancock S Thanksgiving Dinner Harvest Hope Thanksgiving Day

Beer Bottle Vinyl Wall Decal Quote Saying Alcohol Bar Pub Etsy

Samuel Adams Asks Americans To Toast Someone Enlists Top Comedians To Help

Waiting For Liquor License Reform In Boston The Boston Globe